Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

Blog Article

The Main Principles Of Mileagewise - Reconstructing Mileage Logs

Table of ContentsA Biased View of Mileagewise - Reconstructing Mileage LogsThe Facts About Mileagewise - Reconstructing Mileage Logs RevealedSome Of Mileagewise - Reconstructing Mileage LogsEverything about Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs for DummiesThe Main Principles Of Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

Timeero's Shortest Range feature recommends the fastest driving route to your staff members' location. This attribute enhances performance and contributes to cost savings, making it a necessary property for companies with a mobile labor force.Such a strategy to reporting and compliance streamlines the often intricate job of handling gas mileage expenditures. There are numerous benefits related to making use of Timeero to track gas mileage. Let's have a look at some of the application's most notable features. With a trusted mileage monitoring tool, like Timeero there is no requirement to stress over unintentionally leaving out a day or piece of info on timesheets when tax time comes.

The Best Guide To Mileagewise - Reconstructing Mileage Logs

These extra confirmation procedures will certainly keep the Internal revenue service from having a reason to object your gas mileage documents. With precise mileage monitoring innovation, your employees do not have to make harsh mileage price quotes or even worry regarding mileage expenditure monitoring.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all cars and truck expenditures (mileage tracker). You will need to continue tracking gas mileage for job also if you're utilizing the real expense technique. Maintaining gas mileage records is the only way to separate service and individual miles and offer the evidence to the internal revenue service

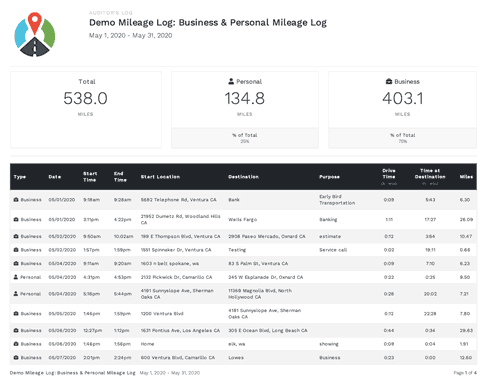

Most mileage trackers let you log your trips by hand while determining the range and reimbursement amounts for you. Numerous also come with real-time journey monitoring - you need to start the application at the beginning of your journey and quit it when you reach your final location. These applications log your begin and end addresses, and time stamps, together with the overall distance and repayment amount.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

This consists of costs such as fuel, maintenance, insurance, and he has a good point the automobile's depreciation. For these expenses to be thought about insurance deductible, the vehicle must be used for business objectives.

Getting My Mileagewise - Reconstructing Mileage Logs To Work

Begin by recording your automobile's odometer reading on January first and after that once more at the end of the year. In between, carefully track all your company trips taking down the starting and finishing readings. For every trip, record the area and service purpose. This can be simplified by maintaining a driving log in your automobile.

This consists of the overall organization mileage and overall gas mileage buildup for the year (organization + individual), trip's day, destination, and objective. It's important to videotape tasks without delay and keep a contemporaneous driving log outlining date, miles driven, and service function. Below's exactly how you can boost record-keeping for audit functions: Beginning with ensuring a meticulous mileage log for all business-related travel.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

The actual expenses technique is a different to the common mileage rate technique. Rather than determining your reduction based on an established price per mile, the real costs approach enables you to subtract the real costs linked with utilizing your car for business purposes - mileage tracker. These costs include gas, maintenance, repair work, insurance, depreciation, and various other associated costs

Those with considerable vehicle-related expenses or unique problems might profit from the actual expenditures technique. Please note electing S-corp status can transform this computation. Eventually, your chosen approach ought to align with your certain monetary goals and tax obligation circumstance. The Criterion Mileage Price is a procedure issued each year by the IRS to establish the deductible prices of running an automobile for organization.

The Best Guide To Mileagewise - Reconstructing Mileage Logs

(https://www.openlearning.com/u/tessfagan-snah4h/)Whenever you use your vehicle for company trips, videotape the miles took a trip. At the end of the year, once more take down the odometer reading. Compute your total service miles by utilizing your beginning and end odometer readings, and your taped business miles. Accurately tracking your exact mileage for service trips help in corroborating your tax reduction, especially if you go with the Requirement Gas mileage method.

Keeping track of your mileage manually can need persistance, but keep in mind, it can save you cash on your taxes. Videotape the overall gas mileage driven.

6 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

And currently nearly every person makes use of General practitioners to obtain around. That means nearly everybody can be tracked as they go about their business.

Report this page